If you watch daytime television, especially talk shows, game shows or reality court dramas, brace yourself for the annual barrage of commercials featuring one-time celebrities urging you to sign up for their favorite Medicare plan.

The come-ons, consumers say, often are misleading and confusing. Focus group participants complain that they can’t tell who has sponsored an ad, that they don’t believe everything an ad claims is free really is free and that they often mistake the spots for official government communications.

The KFF analysis comes as new Centers for Medicare & Medicaid Services (CMS) regulations designed to

clamp down on misleading advertising went into effect on Sept. 30, just in time for this year’s open enrollment period, which will run from Oct. 15 through Dec. 7. As of the 30th, advertisers must disclose what insurance plan their ads are representing. They also can’t misuse the Medicare logo or images of the Medicare card, or suggest that they represent the federal government.

“We are viewing all television, radio and web-based video advertisements in advance to make sure they meet these and other requirements,” CMS Administrator Chiquita Brooks-LaSure said at a September KFF briefing on Medicare Advantage marketing. CMS will be preapproving the Medicare marketing ads this year. “It is incredibly important that people understand as they are being marketed to what they are going to be getting.”

More than 85 percent of all Medicare ads aired during the 2022 open enrollment season were for Medicare Advantage. Most of the remaining advertising was aimed at Medicare Part D prescription drug plans or supplemental — or Medigap — insurance.

Over half of the Advantage spots (55 percent) that were run by brokers and other third parties featured endorsements from celebrities, including actors, athletes and politicians, the KFF analysis found. But only 3 percent of the MA ads from insurance companies used such spokespeople. Most of the ads appeared during the day, although some also aired later during local news programs.

“Enrollees should be protected from bad actors who engage in misleading advertising and marketing tactics,” Mark Hamelburg of America’s Health Insurance Plans, a trade association for health insurance plans, said at the KFF briefing.

The Medicare Advantage ads rarely mentioned the choice between original Medicare and MA plans, the KFF analysis found. CMS runs very few official TV announcements about open enrollment.

A new analysis by the nonpartisan KFF found ads mainly hawking Medicare Advantage (MA) plans ran 650,000 times during last year’s open enrollment period, from Oct. 15 to Dec. 7, 2022. Medicare enrollees tell KFF that they get many unsolicited telephone calls touting Advantage plans, the private alternative to original Medicare, in addition to the constant drumbeat of television ads.

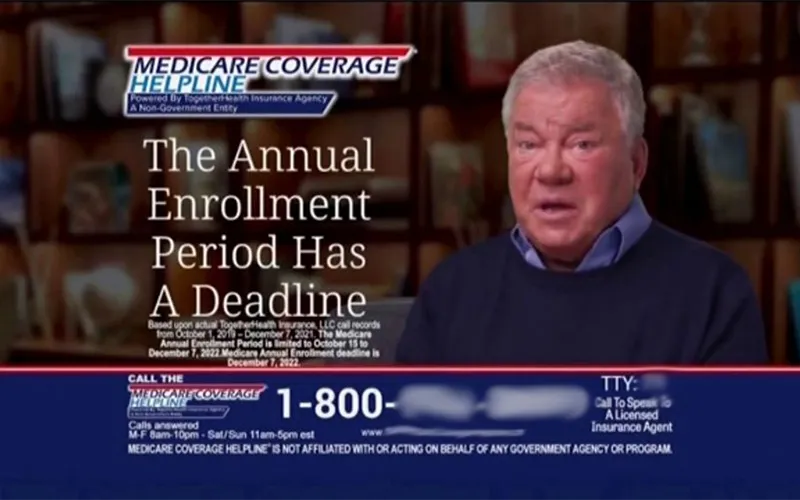

Celebrities frequently hawk plans

Actors like William Shatner and Jimmy Walker and politicians such as former Arkansas Gov. Mike Huckabee were among those appearing in the MA ads. But by far, the celebrity featured most often was former New York Jets quarterback Joe Namath. He appeared in 10 percent (55,839) of all airings during open enrollment in 2022. No other celebrity appeared in more than 1 percent of the spots.

Consumers tell KFF that they may have seen and recognized the celebrities in the ads but that they weren’t persuaded by them.

“I think it’s comedy hour,” a 54-year-old man from Florence, South Carolina, said during a KFF focus group session. “I think it’s some celebrity that’s trying to get a check.”

Experts say that this aggressive marketing has helped lead to an explosion in enrollment in these private insurance alternatives to original Medicare. Enrollment in MA plans has more than doubled since 2008, when only 22 percent of beneficiaries were in Advantage plans. Today, more than half of all Medicare enrollees have chosen an Advantage plan.

Consumer complaints increasing

The KFF report also points to an increase in the number of consumer complaints about Medicare marketing. According to CMS, such complaints about Medicare rose from less than 16,000 in 2020 to nearly 40,000 in the first 11 months of 2021, the latest data available.

For example, many of the ads promised lower premiums for Medicare Part B, which covers doctor visits and other outpatient services. But only 17 percent of Medicare Advantage plans actually offer these Part B premium rebates.

The analysis also found that while the commercials touted extra benefits like dental, vision and hearing coverage, few mentioned the quality ratings — from one to five stars — these plans have that measure such things as quality of care and customer service. The ads also neglected to explain that Advantage plans may require the use of specific provider networks and call for prior approval for certain tests and procedures before a plan will cover them.

Other consumers said the use of an official Medicare card or an image that looks like one, as well as displaying the phone number for a “Medicare hotline,” made them think the commercials were being run by the federal government. In fact, the phone numbers in the ads do not display the actual Medicare hotline, which is 800-633-4227.

More needs to be done

Advocates have applauded the government’s crackdown on misleading ads but say more needs to be done.

“Some counterprogramming would be helpful,” Lindsey Copeland, director of federal policy at the Medicare Rights Center, said at the briefing. “One of the reasons right now for the information gap between MA and original Medicare for people who are new to the program is that MA plans have an interest in making sure people know about them to sign up for them.”

Brooks-LaSure, the CMS administrator, said it’s important for consumers to alert CMS to misleading marketing: “We are committed to finding additional solutions and protections.”

A new blog from AARP’s Public Policy Institute outlines the new CMS regulations and urges more government oversight. “As the number of people who choose Medicare’s private plan option continues to grow, it will become even more important for the federal government to be vigilant in protecting consumers from troubling marketing practices,” the blog says. “This will help ensure that older adults are best equipped to make the coverage decisions that best meet their needs.”

Dena Bunis covers Medicare, health care, health policy and Congress. She also writes the Medicare Made Easy column for the AARP Bulletin.

Find an Elder Law or Special Needs Law Attorney